Xin88| Link Vào Nhà Cái Xin88| Tải App Nhận 1888K

Xin88 luôn là cái tên được nhắc đến nhiều nhất trong danh sách những nhà cái uy tín xanh chín bậc nhất trên thị trường Châu Á. Nơi đây nổi bật với kho game chất lượng hấp dẫn cùng những trải nghiệm mượt mà ổn định. Cùng theo dõi tin tức cập nhật mới nhất về thương hiệu qua nội dung bài viết dưới đây của chúng tôi nhé!

Thông tin khái quát chung về nguồn gốc thương hiệu Xin88

Xin88 trở thành một trong những cái tên quen thuộc trong hoạt động cá cược trực tuyến của thế giới. Với phong cách chuyên nghiệp cùng sự uy tín hàng đầu thương hiệu cam kết mang đến cho hội viên trải nghiệm đẳng cấp nhất. Từ một giao diện thân thiện cho đến chất lượng vượt trội, chúng tôi không ngừng phát triển để đáp ứng nhu cầu tối đa từ khách hàng.

Theo đó Xin88 được biết đến là thương hiệu thuộc tập đoàn giải trí hàng đầu tại Châu Á, chính thức ra mắt vào năm 2015 với trụ sở chính tại Philippines. Tên nhà cái mang hàm ý về phú quý, tài lộc tượng trưng về sự thịnh vượng mà sân chơi muốn mang đến cho hội viên của mình.

Qua từng giai đoạn phát triển thì sân chơi vẫn luôn giữ vững cam kết tạo nên địa chỉ uy tín minh bạch. Đồng thời mở rộng dịch vụ để đáp ứng nhu cầu ngày càng tăng cao từ khách hàng.

Cập nhật về tính pháp lý, tầm nhìn, sứ mệnh của thương hiệu Xin88

Để có được vị thế vững chắc như thời điểm hiện tại sân chơi Xin88 đã không ngừng nâng cấp phát triển dịch vụ của mình. Cụ thể:

Tính pháp lý thương hiệu

Xin88 được cấp giấy phép chứng nhận hoạt động từ những cơ quan hàng đầu trong lĩnh vực cá cược. Vì vậy mà hệ thống luôn đảm bảo tính an toàn hợp pháp cho thông tin cá nhân cũng như giao dịch khách hàng.

Những giấy phép chứng nhận mà sân chơi đang sở hữu gồm có: GEOTRUST, Curacao eGaming, PAGCOR,… Sự công nhận này không chỉ giúp nền tảng thể hiện sự tin tín mà còn cam kết rõ ràng minh bạch tại nền tảng.

Tầm nhìn sứ mệnh thương hiệu Xin88

Nhà cái hoạt động với tiêu chí không chỉ là địa chỉ cá cược mà còn là nền tảng uy tín hướng đến sự bền vững trong lĩnh vực giải trí trực tuyến. Tầm nhìn đến 2023 trang web mong muốn trở thành sân chơi an toàn hàng đầu tại khu vực Châu Á cũng như trên thế giới.

Sứ mệnh của chúng tôi đó là đó cung cấp nên môi trường giải trí minh bạch, an toàn trên từng ván cược. Từ đó tạo nên sự hài lòng tối đa cho khách hàng khi chinh phục kho game mãn nhãn nhất.

Danh mục cá cược sôi động hấp dẫn bậc nhất tại Xin88

Xin88 tự hào là một trong những nền tảng cung cấp dịch vụ cá cược chất lượng và đa dạng nhất hiện nay. Thông qua kho game mãn nhãn, nhà cái hứa hẹn sẽ mang đến những trải nghiệm tuyệt vời nhất cho khách hàng của mình. Trong đó bao gồm:

Thể thao

Nhà cái cung cấp danh mục cá cược thể thao hàng đầu cho khách hàng với đa dạng các bộ môn như bóng rổ, bóng đá, bóng chuyền, tennis và cả thể thao điện tử. Thành viên tham gia dễ dàng theo dõi trực tiếp màn tranh tài và xuống tiền chọn cược cho những kèo hấp dẫn. Chỉ cần anh em chú ý học hỏi và trang bị thêm chút kỹ năng kinh nghiệm thì chắc chắn sẽ có thêm nhiều cơ hội kiếm tiền.

Xổ số

Không chỉ có thể thao mà xổ số tại Xin88 vẫn luôn nhận về sự đánh giá cao từ khách hàng khắp nơi. Thông qua việc cung cấp đầy đủ các loại hình cách đặt cược từ hiện đại cho đến truyền thống như xổ số siêu tốc, mega, keno hay xổ số kiến thiết,.. Tất cả sẽ mang đến trải nghiệm riêng biệt để bạn hoàn toàn không bị nhàm chán khi bắt đầu.

Bắn cá

Bắn cá được biết đến là danh mục giải trí thu hút độc đáo bậc nhất có tại nhà cái Xin88. Thông qua chất lượng hình ảnh âm thanh giao diện rõ ràng sắc nét, hệ thống sinh vật xuất hiện đa dạng, kho vũ khí hiện đại. Tất cả được tích hợp đầy đủ nhất để bạn thỏa sức chinh phục đại dương và trở thành xạ thủ chuyên nghiệp.

Casino

Casino cũng là một trong những danh mục cá cược chưa bao giờ khiến cho khách hàng phải thất vọng tại nhà cái. Bên cạnh việc hợp tác liên kết cùng nhiều đơn vị uy tín thì sân chơi còn mang đến đầy đủ các siêu phẩm đẳng cấp của thế giới như: Rồng Hổ, Poker, Xì Dách, Mậu Binh,… Và nhiều cái tên khác nữa.

Điểm nhấn nổi bật của chuyên mục đó là sự xuất hiện của các cô nàng dealer nóng bỏng chuyên nghiệp trên từng bàn cược. Họ không chỉ đảm nhiệm vị trí chia bài mà còn trực tiếp hướng dẫn, trò chuyện để quá trình trải nghiệm của bạn trở nên sôi động kịch tính hơn.

Các ưu thế nổi bật xây dựng nên sự thành công của Xin88

Như chúng ta đều biết thì hiện nay trên thị trường giải trí trực tuyến có nhiều đơn vị nhà cái khác nhau. Song Xin88 vẫn luôn là điểm đến lý tưởng được đông đảo khách hàng lựa chọn, nguyên nhân có lẽ là do sự xuất hiện của các tính năng như:

Tốc độ load nhanh

Hiện tại trang chủ chính thức của Xin88 được ứng dụng công nghệ tiên tiến bậc nhất, điều này đã tối ưu chất lượng tải trang. Điều này giúp cho anh em hoàn toàn có thể yên tâm mà không cần lo lắng đến vấn đề gián đoạn hay chậm trễ khi tham gia cá cược. Toàn bộ các thao tác trải nghiệm, nhận thưởng đều diễn ra mượt mà ổn định nhất.

Có ứng dụng riêng

Nhằm mang đến sự tiện lợi tối đa cho khách hàng khi sử dụng dịch vụ, nhà cái đã cho ra mắt ứng dụng di động. Người chơi dễ dàng nhấn chọn tải về trên các hệ điều hành và thỏa sức đặt cược mọi lúc mọi nơi mà không bị giới hạn.

Chất lượng hình ảnh 3D

Tất cả các sản phẩm mà Xin88 cung cấp đều được ứng dụng công nghệ 3D cực hiện đại. Điều này đã xây dựng nên không gian sống động và hấp dẫn như được đến trực tiếp tại sòng bài. Khiến người chơi không thể rời mắt ngay từ lần đầu truy cập, chinh phục.

Nạp rút thưởng nhanh chóng

Một trong những ưu điểm nổi bật của nền tảng đó chính là quy trình thực hiện giao dịch diễn ra nhanh chóng an toàn. Ngoài liên kết hợp tác cùng nhiều kênh thanh toán uy tín thì Xin88 còn ứng dụng thêm công nghệ hiện đại. Vì vậy mà các yêu cầu của thành viên được xử lý nhanh chóng, chỉ mất khoảng 1 – 3 phút là có thể hoàn tất, đáp ứng nhu cầu cá cược.

Nhiều sản phẩm

Nhà cái còn mang đến cho khách hàng của mình một danh mục cá cược mãn nhãn. Với sự xuất hiện của đầy đủ những cái tên đang “làm mưa, làm gió” trên thị trường. Nhờ vậy mà bạn yên tâm lựa chọn và thử sức theo nhu cầu bản thân mà không bị nhàm chán.

Hỗ trợ tuyệt vời

Nhà cái cũng đặc biệt chú trọng đến dịch vụ chăm sóc khách hàng của mình. Vì vậy nền tảng có cả đội ngũ chuyên viên tận tâm chuyên nghiệp, với thái độ tận tình họ luôn sẵn sàng hỗ trợ giải quyết thắc mắc của khách hàng mà không gây ảnh hưởng đến việc trải nghiệm.

Thông tin các đối tác uy tín của thương hiệu Xin88

Như đã chia sẻ thì ở thời điểm hiện tại Xin88 có sự hợp tác liên kết cùng nhiều đối tác uy tín hàng đầu trên thế giới. Điều này đã xây dựng nên kho game đa dạng chất lượng nhất để bạn yên tâm lựa chọn và chinh phục theo sở thích cá nhân. Cụ thể:

- Jili: Jili được biết đến là thương hiệu phát hành trò chơi nổi tiếng với các sản phẩm đỉnh cao. Sự hợp tác này đã tạo nên thiên đường giải trí độc đáo thú vị cho tài khoản chính thức tại nhà cái.

- JBD: Đây là thương hiệu nổi tiếng với các trò chơi casino đa dạng chất lượng cao. Đặc biệt tỷ lệ đổi trả thưởng cũng luôn ở mức hậu hĩnh để anh em tận dụng gia tăng lợi nhuận nhanh chóng.

- TP: Đơn vị phát hành nổi tiếng với các trò chơi mang tính tương tác cao. Ngoài ra TP cũng đặc biệt chú trọng phát triển hệ thống hình ảnh âm thanh tạo nên sản phẩm đẳng cấp nhất cho khách hàng.

- Sbobet: Đây là nhà phát hành nổi tiếng trên thị trường với dịch vụ cá cược thể thao. Thông qua việc cập nhật thường xuyên các sự kiện, giải đấu cùng kèo cược mãn nhãn hứa hẹn sẽ mang đến những trải nghiệm lý tưởng nhất cho khách hàng.

- UG: Khi nhắc đến các thương hiệu phát hành nổi bật có tại Xin88 chúng ta không thể bỏ qua cái tên UG. Nơi đây chuyên cung cấp các tựa game slot cuốn hút độc đáo cùng khoản thưởng hậu hĩnh để bạn làm giàu nhanh chóng.

Hướng dẫn các thao tác trải nghiệm đơn giản nhất tại Xin88

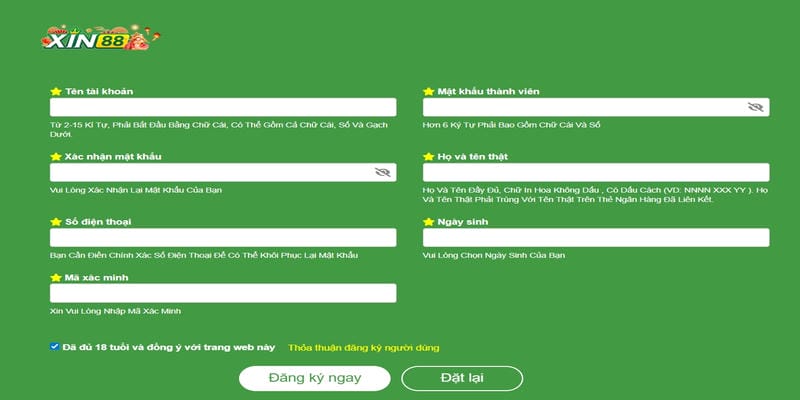

Lựa chọn cá cược tại sân chơi, việc đăng ký là quy trình quan trọng mà khách hàng cần thực hiện, cụ thể như sau:

- Bước 1: Trước hết bạn cần xác định đâu là URL chính chủ của nhà cái, chú ý kiểm tra kỹ lưỡng để khắc phục tuyệt đối với vấn đề lừa đảo giả mạo.

- Bước 2: trên trang chủ chính hãy click biểu tượng “đăng ký” có tại vị trí góc phải.

- Bước 3: Lúc này trên màn hình chính sẽ xuất hiện biểu mẫu với các yêu cầu gồm có họ tên, số điện thoại, mật khẩu và mã xác nhận. Người chơi cần điền chính xác các dữ liệu này trùng khớp với tên trên tài khoản ngân hàng để việc xác nhận diễn ra nhanh chóng.

- Bước 4: Cuối cùng bạn chỉ cần kiểm tra lại để chắc chắn mọi thứ đều chính xác, chọn hoàn tất và chờ đợi thông báo thành công. Như vậy là anh em có thể tiến hành đăng nhập, thực hiện giao dịch nạp tiền để chinh phục kho game mãn nhãn.

Kết luận

Tin tức trên của bài viết đã cập nhật chi tiết về thương hiệu Xin88 đến cho khách hàng chính thức. Hy vọng dịch vụ nổi bật, sản phẩm chất lượng của nhà cái sẽ tạo nên giây phút giải trí an toàn nhất cho bạn.